A recent report by MarkNtel Advisors reveals that the GCC Financial Cards Payments Market is expected to grow at a compounded annual growth rate (CAGR) of approximately 11.2% during 2023-28. The report provides a detailed understanding of the industry, including key drivers, challenges, opportunities, and latest trends. It also examines the competitive landscape recent advancements made by leading companies operating in the industry, along with their range of product/service offerings, growth strategies, and presence in different regions/countries.

Our experts have used both primary secondary research methods to gather accurate and comprehensive information about the GCC Financial Cards Payments Market. The study also covers potential growth barriers to the market and highlights untapped opportunities while providing recommendations for stakeholders to prepare for unexpected situations that may arise in the future. The report considers historical data from 2023-28 as the starting point and provides forecasts for the years 2023 to 2028. All market values presented are in USD Million/Billion.

Get Your Complimentary Sample Report Now! https://www.marknteladvisors.com/query/request-sample/gcc-financial-cards-payments-market.html

Goals of the GCC Financial Cards Payments Market Research Study

- To provide valuable insights into aspects like drivers, challenges, opportunities, threats that impact the growth of the GCC Financial Cards Payments Market

- To have a complete understanding of the value chain through Porter's five forces model

- To identify positioning of major participants in the GCC Financial Cards Payments Market, along with their competitive advancements like collaborations, mergers acquisitions, new product releases, and investments in research development.

- To provide thorough information to stakeholders on growth opportunities in fast-growing segments

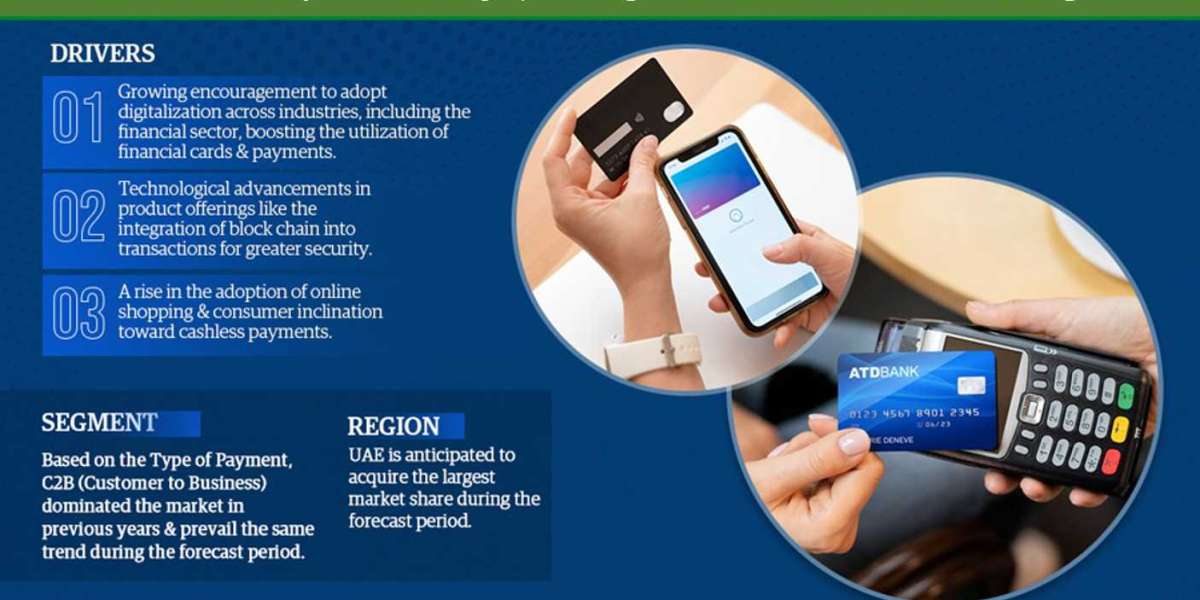

Market Dynamics

Expanding E-commerce Industry Across the Region

The growing e-commerce industry across the GCC region has well-supported the financial cards and payments market in the historical years. The countries, such as the UAE, Saudi Arabia, Qatar, etc., have witnessed a significant surge in online retail sales due to high investments by the global retail players in the lucrative market GCC. For instance, in 2020, Carrefour and Lulu Group, two of the largest retailers in the Middle East, launched their online shopping portals in the UAE. The countries, including the UAE, Qatar, Kuwait, and Bahrain have almost 100% of the population with internet and mobile phone access.

Due to this, the transactional volume through payments made via financial cards, such as debit cards, prepaid cards, credit cards, etc., has increased considerably. According to the International Trade Administration (ITA), e-commerce sales in the UAE recorded USD3.9 billion in revenues during 2020, a jump of 53% from 2019. Moreover, the Dubai Chamber of Commerce and Industry forecasts e-commerce to generate USD8 billion in sales by the year 2025. Hence, it is expected that the ever-growing e-commerce market in the region would promulgate the demand for financial cards and payments in the forecast years.

A Detailed Analysis of Major Segments Driving the GCC Financial Cards Payments Market Growth

In this section, the report explores the GCC Financial Cards Payments Market's dynamic landscape, dissected into multiple segments and sub-segments, along with pivotal factors propelling industry growth, to help stakeholders optimize their positioning, target audience, and revenue tactics.

Based on Type of Card

- Credit Card

- Debit Card

- Charge Card

- Prepaid Card

Based on Type of Payments

- B2B

- B2C

- C2C

- C2B

-- E-Commerce Shopping

-- Payments at POS Terminals

-- Others

Based on Type of Transactions

- Domestic

- Foreign

Based on Card Issuing Institution

- Banking

- Non-Banking

Geographically, the GCC Financial Cards Payments Market expands across:

- Saudi Arabia

- The UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Immerse Yourself in the Complete Report: Explore Extensive Research, Market Segmentation, and Competitive Landscape Analysis - https://www.marknteladvisors.com/research-library/gcc-financial-cards-payments-market.html

Note: The GCC Financial Cards Payments Market research report can be tailored as per individual client needs, providing comprehensive valuable insights at various levels. This personalized approach enables clients to understand the industry's true potential, effectively tackle growth challenges, devise effective strategies, and make well-informed decisions to maintain a competitive edge in the industry.

GCC Financial Cards Payments Market Research Report: Key Questions Addressed

- What is the estimated size, share, CAGR of the GCC Financial Cards Payments Marketduring 2023-28?

- Which segments sub-segments are considered most prevalent in the GCC Financial Cards Payments Marketresearch study?

- What are the major regions/countries would offer remunerative prospects to the key players in the GCC Financial Cards Payments Market?

- What are the geographical trends and recent developments in the GCC Financial Cards Payments Market?

- Which products/services would witness rapidly growing demand in the GCC Financial Cards Payments Market through 2028?

A Detailed Assessment of Major Companies in the GCC Financial Cards Payments Market and their Key Growth Strategies

The competitive landscape section of the report unveils the top players in the GCC Financial Cards Payments Industry, their financials, resources, product offerings, market share, strategic initiatives, RD investments, strengths, weaknesses. All the findings hypothesis on the market ecosystem have been carefully validated through a detailed Porter's five forces analysis.

Companies like,

- Visa

- Mastercard

- American Express

- Citibank

- HSBC

- PayPal express checkout

- HDFC Bank

- Diners Club

- Barclays

- Hyperpay

- Others

often involve in collaborations for joint venture programs resource sharing to achieve their objectives efficiently.

Talk to our consultant - https://www.marknteladvisors.com/query/talk-to-our-consultant/gcc-financial-cards-payments-market.html

About MarkNtel Advisors

MarkNtel Advisors is a leading research, consulting, data analytics firm that provides an extensive range of strategic reports on diverse industry verticals. We deliver data to a substantial varied client base, including multinational corporations, financial institutions, governments, individuals, among others.

Our specialization in niche industries emerging geographies allows our clients to formulate their strategies in a much more informed way and entail parameters like Go-to-Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing forecasting, trend analysis, among others, for 15 diverse industrial verticals. Using such information, our clients can identify attractive investment opportunities strategize their moves to yield higher ROI (Return of Interest) through an early mover advantage with top-management approaches.

*For further information, kindly contact our sales team, and allow us to guide your purchase and customization queries.

Media Representative

Email: sales@marknteladvisors.com

Phone: +1 628 895 8081 +91 120 4278433,

Address: 5234F Diamond Heights Blvd #3092,

San Francisco, CA 94131, United States